nys tax fresh start program

Read and understand all terms prior to enrollment. FRESH provides tax breaks for supermarket operators and developers seeking to build or renovate new retail space to be owned or leased by a full-line supermarket operator.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Обідня перерва з 12 год.

. If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year. Individuals and businesses that are insolvent or discharged in bankruptcy and. Individual results may vary based on ability to save funds and completion of all program terms.

Tetiana Kirienko and representatives of the Office of Technical Assistance of the US Treasury Department discussed improvement of tax administration. And taxpayers may also waive receiving the said notice if they are going to pay their tax debt via the Direct Debit Installment Agreement. NYS Tax Department CED Offer In Compromise Unit W A Harriman Campus Albany NY 12227-5100.

Once you have completed all necessary forms and gathered all supporting documentation send everything to the following address. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. IRS Fresh Start Program New York.

Legal Fees to defend you. We can consider offers in compromise from. If the tax bill is more than 100000 a New York Supreme Court judge needs to approve the OIC.

The Offer in Compromise program allows qualifying financially distressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a reasonable portion of their tax debt. This is for youlet us know what you think. Mailing Your Offer In Compromise.

The other IRS Fresh Start program option that is useful is a tax payment plan. Total Potential Cost Impact. The Financial Education Program is a series of short modules and videos designed to take you through the benefits available to you and the responsibilities you have as a New York State taxpayer.

As Heard on CNN. 044 520-61-52 044 520-61-54 044 520-61-56 044 520-61-78 044 520-61-28 044 520-61-26. Weve argued for an emergency cut in VAT of 25 per cent that would.

He told Times Radio. Program does not assume any debts nor provide legal or tax advice. If you set up a streamlined payment plan with the IRS the agency wont file a lien.

If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways. Interest and penalties still accrue so it is not an inexpensive option and perhaps not even the best option. All groups and messages.

Get Free Competing Quotes For Fresh Start Tax Program. Ad Dont Face the IRS Alone. Food Retail Expansion to Support Health or FRESH Program.

Pay IRS back for cost of Prosecution. Відділ надання адміністративних та інших послуг. May be stabilized at pre-improvement real estate tax amounts for up to 25 years with benefits phasing out at not more than 20 percent per year starting in year 21.

The IRS can enter into a payment plan of up to 96 months to allow a taxpayer to pay the tax debt over that period of time. Tax Avoidance Fine 250K. START-UP NY program The START-UP NY program provides tax benefits to approved businesses that locate in vacant space or land of approved New York State public and private colleges and universities approved strategic state assets and New York State incubators affiliated with private universities or colleges that are designated as tax-free NY.

Conviction for example carries a weight of 5 years imprisonment and will even fine those guilty of evasion for 250000. Through the Fresh Start program the maximum amount of tax liability that would merit a Notice Of Federal Tax Lien has been. Fresh Start in 2011 to help struggling taxpayers.

Tax evasion comes with very heavy penalties. It means a tax cut for people who are struggling. The IRS Fresh Start program is an excellent initiative for those taxpayers who have difficulty in clearing their tax debt in one payment.

They can now conveniently do so by paying the amount in different pay periods over an extended period. Відділ електронних сервісів та звітності. You can start anywhere in the series or review all the modules.

Through the Fresh Start program the maximum amount of tax liability that would merit a Notice Of Federal Tax Lien has been increased from 5000 to 10000. The Smart Traveler Enrollment Program is a free service that allows US. Loss of Income from 5 Years of Imprisonment46KYear 230K.

Basically this is how this IRS Fresh Start program works. The crucial aspects of the fresh start program have been discussed in this article. Ad End Your IRS Tax Problems.

Citizens traveling or living abroad to receive the latest security updates from the nearest US. Avoiding the IRS can be very costly. That means you can agree to an installment payment plan to pay off up to 50000 in debt without worrying that the IRS will place a lien on your property or belongings.

Representatives of the State Tax Service and the Business Ombudsman Council discussed formats of further cooperation. Benefits of enrolling in STEP. The Fresh Start program also introduced a way to avoid a federal tax lien even if you owe 10000 or more.

Medicare Can Be Confusing 6 Of Your Top Questions Answered Published 2019 Medicare Skilled Nursing Facility Dental Coverage

A Complete Guide To New York Payroll Taxes

Pass Through Entity Tax 101 Baker Tilly

100 Cold Pressed Organic Living Juice Cleanse 8 Bottles Per Day

It S Just That Easy Filing Taxes Start Program Tax Debt

One Page Brochure Template New Fitness Cover Letter Fresh Google Tri Fold Brochure Template New A A 10 Project Manager Resume Resume Skills Business Analyst

Hiring Incentives Tax Credits And Funding Opportunities Department Of Labor

Advertising Agency Invoice Template Google Docs Google Sheets Illustrator Indesign Excel Word Apple Numbers Psd Template Net

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

5 Traits Of A Resume That Will Get You Hired Cover Letter For Resume Resume Career Advice

A Better Way Than 421 A Office Of The New York City Comptroller Brad Lander

New York Sales Tax Everything You Need To Know Smartasset

The 421a Tax Abatement In Nyc Explained Hauseit Nyc Tax Property Tax

Form 656 Ppv Offer In Compromise Periodic Payment Voucher Offer In Compromise Tax Debt Debt Problem

Restaurant Marketing Ideas For August Infographic

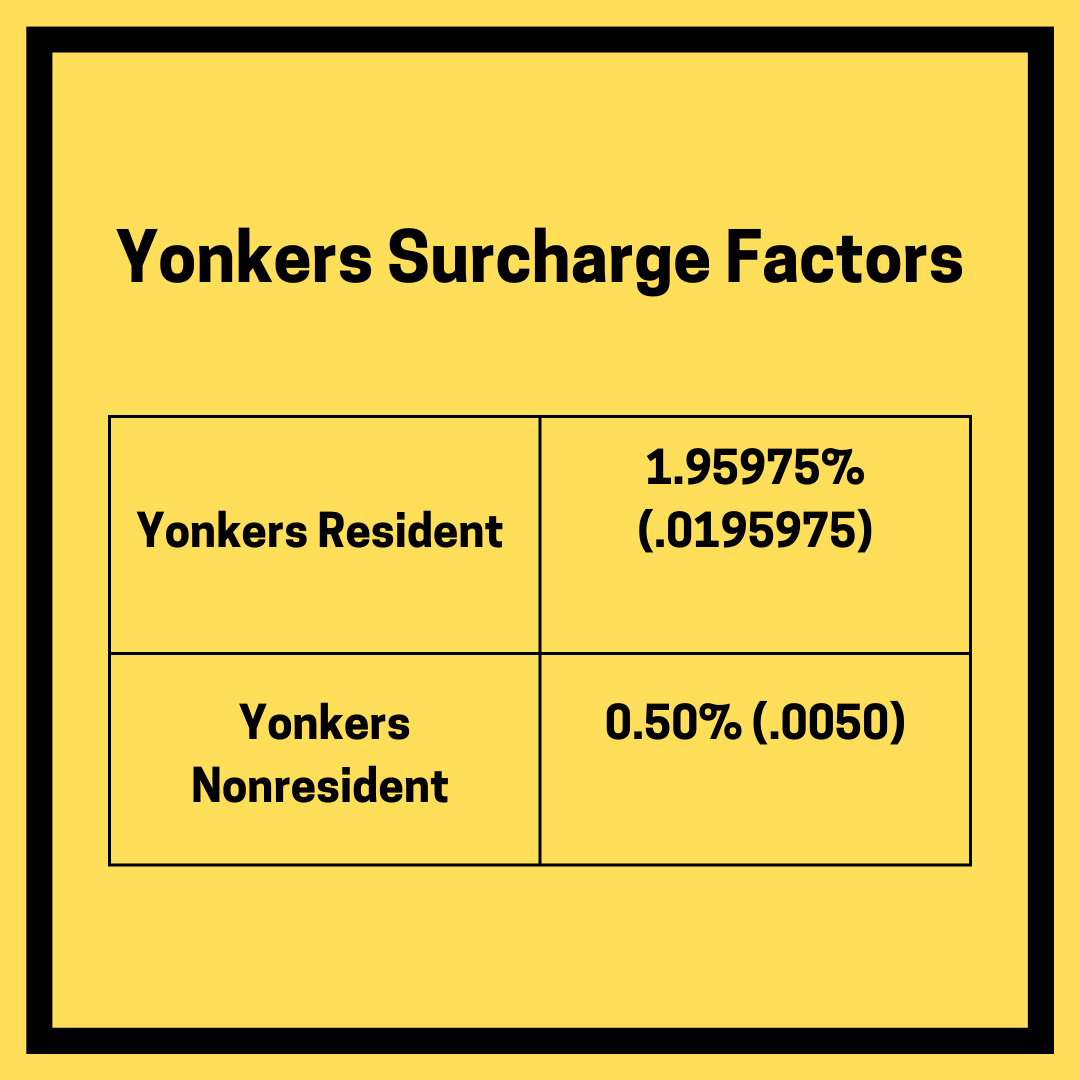

A Complete Guide To New York Payroll Taxes

Financial Advisor Resume Examples Writing Tips 2022 Free Guide